SPRINGFIELD, Mass. — LGBTQ Middle Americans are more likely to worry about the direction of the country, feel less financially secure, and struggle more with personal financial issues than other Americans, according to research by Massachusetts Mutual Life Insurance Co. (MassMutual).

“Nearly half (47 percent) of Middle-income earners who are lesbian, gay, bisexual, transgender, queer or questioning (LGBTQ) say they feel less than financially secure and many often struggle with financial emergencies,” said Wonhong Lee, head of diverse markets with MassMutual. “Overall, LGBTQ individuals tend to worry more about finances and are impacted more negatively by their finances than other Middle Americans. For instance, 60 percent of LGBTQ individuals report often worrying everyday about their household’s financial situation, compared to 53 percent of the general population.”

While many LGBTQ Americans worry about money, 80 percent of survey respondents said they are worried about the direction of the country, compared to 66 percent of the general population, according to the MassMutual LGBTQ Middle America Financial Security Study. LGBTQ Middle Americans are also more likely to be worried that changes to the healthcare system could cause a loss of coverage for them or a loved one. The research polled 500 respondents who identified themselves as LGBTQ as part of a broader study of working Americans ages 25-65 who earned annual incomes of between $35,000 and $150,000.

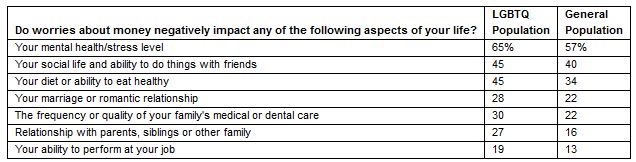

In addition to concerns about politics, LGBTQ respondents expressed higher levels of concerns than the general population about finances (60 percent vs. 54 percent, respectively), the health and well-being of parents (54 percent to 51 percent, respectively), and their marriage and/or romantic relationship (28 percent to 22 percent, respectively). LGBTQ Americans who expressed concerns about their personal finances were more likely to be impacted than other Middle Americans as a result.

Reasons for Worry

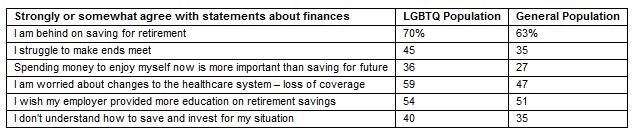

The study showed differences in attitudes about saving as well as concerns about a wide range of financial issues, including lack of preparation for retirement, struggling to make ends meet, a need for more education about retirement savings and financial issues, and potential changes to the healthcare system.

Living for Today

The attitude expressed by LGBTQ respondents about a greater propensity to spend rather than save underscored an overall lack of savings. Those identifying themselves as LGBTQ were more likely to agree that “spending money to enjoy myself now is more important than saving for the future” than other Middle Americans, 36 percent to 27 percent, respectively.

Meanwhile, fewer than one in four (27 percent) LGBTQ respondents have at least $5,000 in savings set aside for emergencies and 44 percent said an unexpected expense of $5,000 would create at least some if not significant discomfort. Both those levels were higher than reported by the general population.

Managing finances is also more of a challenge for the LGBTQ population, with 59 percent saying they don’t always have enough money every month compared to 48 percent of the general population, the study found. Half of LGBTQ workers with lower incomes (less than $45,000) found it difficult to manage their household expenses. Both LGBTQ (54 percent) and the general population (53 percent) attributed personal financial issues to high levels of debt.

LGBTQ Middle Americans also expressed concerns about having different financial planning needs than the average household, more difficulty finding financial support and greater interest in financial education. More than half (53 percent) said they are unsure where to go for financial advice.

“The financial services industry needs to continue to get closer to its customers to better understand their individual needs, as MassMutual’s study of LGBTQ Middle Americans plainly shows,” Lee said. “There are many different types of households and families in America. Both our challenge, and our opportunity, is to better understand how we can help all types of households and families prioritize managing their money, enhance their financial security and reach their financial goals.”