Pride weekend is history. All of that fun and celebration creates great memories; and you might find some more reminders of Pride 2012 once you open up your next credit card statements. You aren’t alone if you used a credit card that weekend because you ran out of cash. For a lot of people, yanking out the plastic is a natural reaction to spending that last bit of real currency. There’s a reason the average American household has about $16,000 in credit card debt.

There are a few different strategies to tackle credit card debt. I’ll talk about my favorite one in a minute; but no matter what method you choose, the first two steps are always the same. The first step is to write down all of your balances, interest rates, and minimum payments for each card.

It’s pretty common for folks with lots of credit card debt not to look at their debt balances. (Ignorance is bliss!) Writing it all down can be extremely scary; but also therapeutic. Staring at the totals will build your resolve to fix the problem and move onto the second step.

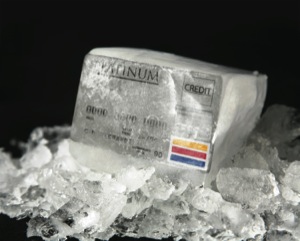

The second step is to stop using your credit cards. Put them in a container, fill it with water, and place in the freezer. This stops those impulse purchases. Your wits will come back before the ice melts and you’ll decide not to buy that thing you don’t need.

Now that you’ve acknowledged there’s a problem, it’s time to start paying it off. Here are the steps to do it:

1) Choose a monthly budgeted amount to pay toward credit cards.

2) Make the minimum payments on all the credit cards with the lowest interest rates.

3) Use the rest of your budgeted amount to pay down the highest interest rate credit card.

The steps are pretty simple, but an example can help us visualize the details. Let’s say you have a MasterCard with an 18 percent interest rate and a minimum payment of $50. There’s also a Visa with a 13 percent interest rate and minimum payment of $100.

The total minimum payments are $150. This $150 will now be a fixed amount in your budget until all of the credit card debt is paid. So you make the minimum payments of $150 this first month.

Then the total minimum payments decrease for the next month because you stopped charging on your cards. For the second month, make the minimum payment on the 13 percent Visa and use what’s left of the $150 to pay down the 18 percent MasterCard. The end result is a larger amount going toward the card with the highest interest rate.

It doesn’t seem like much at first, but soon you’ll be making an extra $10, $25 and $50 a month to pay down that 18 percent MasterCard. Eventually it will be paid off. And then you move on to the 13 percent Visa while still paying $150 per month regardless of the minimum payment.

Be sure to track your progress. It’s a great motivator to see those debt totals decrease each month. Getting control of your debt is the first step to financial independence. Stop putting it off. Make a plan to tackle your credit card debt and get it done.

Steve Doster is a Certified Financial Planner™ professional providing commission-free financial advice for do-it-yourself investors. You can reach Steve at Doster Financial Planning by phone (619) 688-1192 or email steve@dosterfinancialplanning.com. You can also follow Steve on Facebook, Linked In, Twitter, or blog to get more personal finance advice and tips.