A new study at CNN Money reveals that couples in same-sex marriages lose nearly $6,000 a year in federal tax benefits since the federal government does not legally recognize their union.

While same-sex spouses are entitled to some state benefits, the Defense of Marriage Act (DOMA) prevents those married legally in their states to file their federal return jointly, resulting in financial discrimination for couples who are legally married in their respective states.

The translation: those in gay marriages are not entitled to the same benefits as married heterosexual couples. While the study does not necessarily illuminate this fact for the first time, it’s one of the first studies to break down the financial discrimination presented by the federal government in wake of the legalization of DOMA.

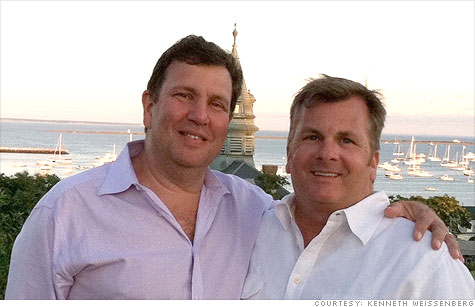

“It’s costing these families thousands of dollars a year, as well as the emotional pain and suffering,” said Ken Weissenberg, a partner at accounting firm EisnerAmper, in a statement to CNN Money. Weissenberg is also a partner in a same-sex marriage.

CNN Money explains:

One scenario involved families with one spouse earning $100,000 and the other spouse staying at home with the family’s two kids. In the same-sex family’s case, the working spouse files as “head of household,” and the stay-at-home spouse is considered a “qualifying relative.”

Say that couple reported no other income or deductions. In that case, the same-sex household’s federal tax bill is $15,199, which includes tax the head of household must pay on health insurance premiums to cover the stay-at-home spouse. That’s $4,543 higher than the straight couple’s liability.

Why? Because the “head of household” designation comes with some disadvantages. Filing as “head of household” instead of “married filing jointly” exposes more income to a higher tax bracket. Plus, standard deductions, which are given based on the filing status to taxpayers who don’t itemize deductions, are lower for a head of household than they are for married couples filing jointly.

Despite the federal gap in benefits, Weissenberg explains that “[the federal government tax laws] shouldn’t stop anyone from getting married. If I had to pay twice as much in taxes to be married to my husband, I would.”

Gay Americans are not second class citizens to be merely ignored at the whim of bigots. My husband and I have been waiting since late last September for a decision on an appeal we made to the Social Security Administration’s sudden disqualifucation of my Social Security early retirement benefits. Their actions were and are based on a mid-2010 ruling by the IRS which disqualified me for early retirement benefits because I was married legally in a community property state, yet the same ruling doesn’t apply to heterosexual marriages. They now want me to pay back all benefits received in 2010 and reduce my husband’s future benefits he would get if we were a heterosexual married couple. There are so many more cases of government legalized discrimination and denial of rights and benefits based on who we as legal consenting adults choose to marry and yet still these tragic injustices continue!

I first reported on this struggle in last October’s issue of The RAGE Monthly and the article went national through the EDGE of Boston network. Please see the article link:

http://www.ragemonthly.com/2011/10/10/irs-creates-clash-between-doma-and-state-sovereignty/

I have been in contact with the CNN author of the article Frank has shared here and CNN is considering a series of informative articles on this very topic. Please share your stories…we can change these injustices now!