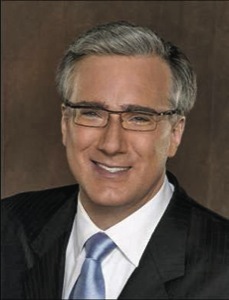

Before we dive into real estate this week, al-low me a few lines to say “goodbye and good luck” to our fiercest of straight allies Keith Olbermann. My husband Michael and I were watching Olber-mann’s MSNBC show Countdown when the host off-handedly stated Friday’s edition would be his last. Shocked, we were hoping the disclosure was the first part of an on-air prank, but soon our worst fears were realized. Our hero is going dark after numerous dust-ups with network suits whose limits Olbermann repeatedly tested.

The American LGBT community owes Keith Olbermann a huge debt of gratitude. He took up our cause time and time again. He was a champion of the best kind – with no personal agenda in the LGBT rights race; he could have been like most of the “left-leaning” mainstream media when it comes to our rights – silent. He was not. He sought out stories to underscore the inequality and hatred we endure. He shined a bright light on the hypocrisy of conservative politicians and did not mince words.

Who will ever forget his “Special Comment” on Prop 8 that aired on November 10, 2008? Just six days after our loss of marriage rights, here came Olbermann reminding us, commanding us to fight on. It’s worth watching again and you can find it on youtube.com along with his other inspiring pieces on DADT.

Olbermann did a lot with his microphone, raising millions of dollars for the National Association of Free Clinics, and helping to focus attention on transplant patients in Arizona having their life-saving surgeries cancelled by an inept and uncaring conservative governor.

He also let us into his life. The poignant stories surrounding the deaths of both his mother and father played out in raw, real time on his show. His tributes to them are television tours-de-force and they allowed his viewers to see the great heart and the private pain of a real human being.

Olbermann helped to build a reputable team of liberal colleagues that has turned MSNBC into the thinking-person’s antidote to Fox News. His obvious collegiality towards MSNBC anchors Rachel Maddow, Lawrence O’Donnell, and Ed Schultz is only slightly less amazing than the complete turnaround of Chris Matthews – whose enlightenment has Olbermann’s fingerprints all over it. He is the type of guy you want to work with – always looking for a way to help his colleagues up, not just out. Good Luck, Keith! I miss you already.

President Obama to the Rescue

Last Thursday, the Obama ad-mini-stration an-nounced proposed new federal regulations to prevent housing discrimination based on gender orientation and gender identity. While LGBT Californians already enjoy most of these protections, most LGBT Americans do not. Watch for more regulatory relief on LGBT issues as the GOP-controlled house isn’t likely to bring anything useful our way via the legislative process. Although subsequent presidents could reverse these basic protections, once they become engrained in the policy and procedures of HUD, FHA and every lender who does government-insured loans, taking them back would be tough, expensive and not worth the trouble.

The Mortgage Re-Invented?

Jack Guttentag, the emeritus professor from the University of Pennsylvania’s Wharton School and one of the country’s leading academics on the subject of home mortgages has a fascinating series coming out in his Inman News column. (Inman is the online news source for all things real estate.) He predicts a new way for consumers to secure mortgages through online, third-party sites that certify participating lenders and affiliated services (title insurers, escrow holders) and guarantee good outcomes.

In the past, online mortgage sites delivered decidedly mixed results to consumers.

Lending Tree’s famous tagline “When banks compete, you win,” didn’t always hold true. Most sites ended up either as single-lender enterprises or lead generation operations that simply sold contact inquiries to the highest bidder. In most cases, consumers could have done better.

Consumer confidence as it pertains to housing is at an all time low. Buyers are well-aware of the wreckage wrought by the failure of the United States to regulate its banking sector and protect a crucial segment of the economy. Who can blame them now for exercising caution? Most of them have a disdain for the Wall Street banks that created the housing collapse and certainly aren’t ready to trust them again, let alone take out a loan from the same firms who caused the current collapse. Guttentag’s methods may be an alternative and one that couldn’t come at a better time. Stay tuned for more in coming weeks.

The DL on Low Down Payment Purchasing

With mortgage rates bouncing around under 5% and prices still low, first time home buyers are making the best out of a sluggish market. Many of you ask me what you can expect to pay in costs for your first home. While mortgage costs vary widely due to unique factors with each borrower, FHA’s costs are mostly set. One thing to remember is that with FHA’s minimum down loan (3.5%) you are required to prepay a substantial amount towards impounds, private mortgage insurance and pre-paid interest. Last week I wrote about our daughter Breanne’s recent purchase of her first home.

Along with other miscellaneous costs, Breanne’s total debits came very close to $300,000 of which her principal loan amount is $277,775 at a fixed rate of 4.875%. Her monthly principal, interest and mortgage insurance payment comes to $1675. Adding her homeowner’s insurance and property taxes her total payment is $2070.

The FHA minimum down program is available to buyers with minimum credit scores of 620 and loan amounts up to $417,000. Condos must be FHA approved – a process that by itself takes about 60 days. The property being purchased must be your primary residence. Thanks to lender Sam Assael for the details. He can be reached at sam@alliancedirecthm.com. He will happily talk to you about your next home loan.

Jim Abbott is the President/Managing Broker of ARG Abbott Realty Group DRE LIC 1843472. He serves on the Board of Directors of the Natl Assn of Gay and Lesbian Real Estate Professionals. He is a former board member at EQCA, SDAR, CAR and a past Library Commissioner for the City of San Diego. He can be reached at info@argsd.com or at his downtown office where his adult children pretend to let him run the company.

well explained. Thanks a lot